As we all continue to adapt to an interim reality, we have to plan ahead to ensure we can continue to live responsibly.

Everyone is juggling new challenges, questions, especially where our finances and jobs are concerned. You’re not alone. Most businesses/employers in Calgary are or will be filling for a number of Federal Government initiatives, including payroll subsidies and cash infusion loans. Some of these items are helpful, but remember, loans still have to be paid back, as do deferrals.

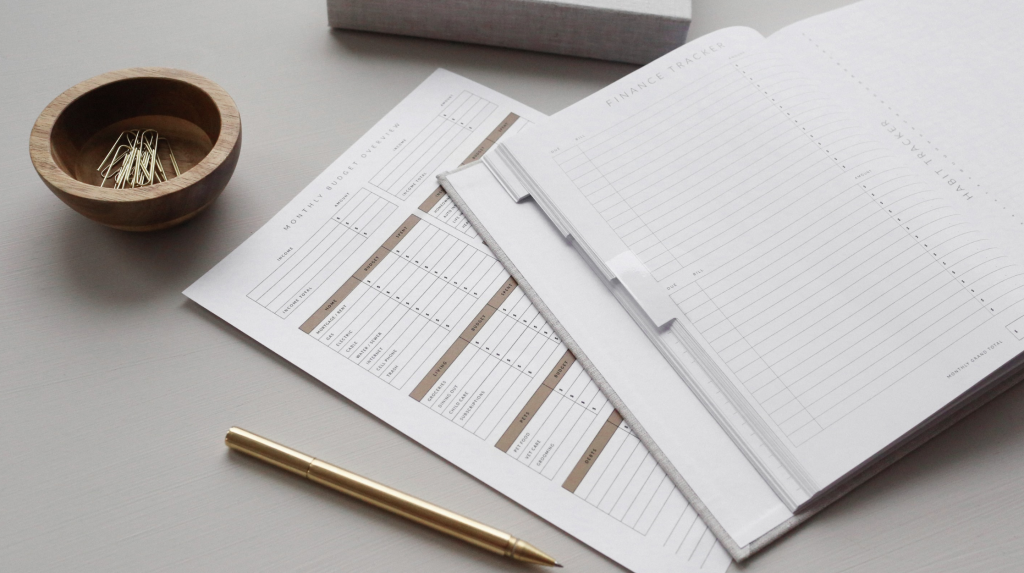

In order to keep accountable to your finances in order to succeed financially post-Covid, we recommend the following steps:

Trim the fat.

Look at any personal or business budgets. What can you afford to cut? What is a luxury item? If it’s a want versus a need, it should go for now.

Look at your income, assets and debt.

If you aren’t bringing in as much income as before the crisis, determine your new baseline and how much you are projected to bring in moving forward – this will help with budget cuts. Take a peek at your assets, can you afford to liquidate or pull any of them out? Your mortgage can also potentially be re-financed if needed. Look at your debt. If possible, keep paying it off. Any good financial expert will tell you to do two things simultaneously, save and pay off debt. This will support your overall financial health.

Spend strategically.

Having your budget in tact is more important than ever. Itemize your expenses by fixed and variable and know what you can afford to cut. Check out cash back apps or services to support in savings and take back old school – coupons are still a great way to save, especially with gas or groceries.

In short, re-consider your spending, be organized and be cognizant of your spending.

If you need support or have questions about your mortgage, reach out to us!